Designing Trust: From First Tap to Everyday Finance

Live link

Overview

Early-stage fintech products lose a large percentage of users before the first transaction. The biggest reason isn’t UI quality, it’s when sensitive actions are requested.

This project explores how re-ordering onboarding steps and designing for trust-first activation can increase first-deposit conversion.

The Problem

Most fintech onboarding flows request high-risk information too early:

Debit card details

Full KYC data

PIN setup

All before the user understands product value.

This leads to:

High early drop-off

Fear-based abandonment

Low activation rates

The Design Goal

Design an onboarding flow that:

Builds trust before asking for sensitive data

Creates momentum with a clear first success moment

Drives users toward their first meaningful action: funding their account

The Constraints

Must support KYC and card linking

Must remain under 2 minutes total flow time

Must be intuitive for first-time fintech users

Mobile-first experience

Flow Strategy

Instead of asking for everything at once, the flow is deliberately sequenced into three psychological phases:

Onboarding Flow Breakdown

Setting Expectations Before Asking for Information

Before asking users for any personal information, the product answers one quiet question:

“Can I trust this?”

Instead of starting with forms, I introduced a short three-screen sequence that establishes clarity, utility, and confidence in under 10 seconds.

Splash screen framework

By the time users reach onboarding, they are no longer evaluating the product —

they are already inside the experience.

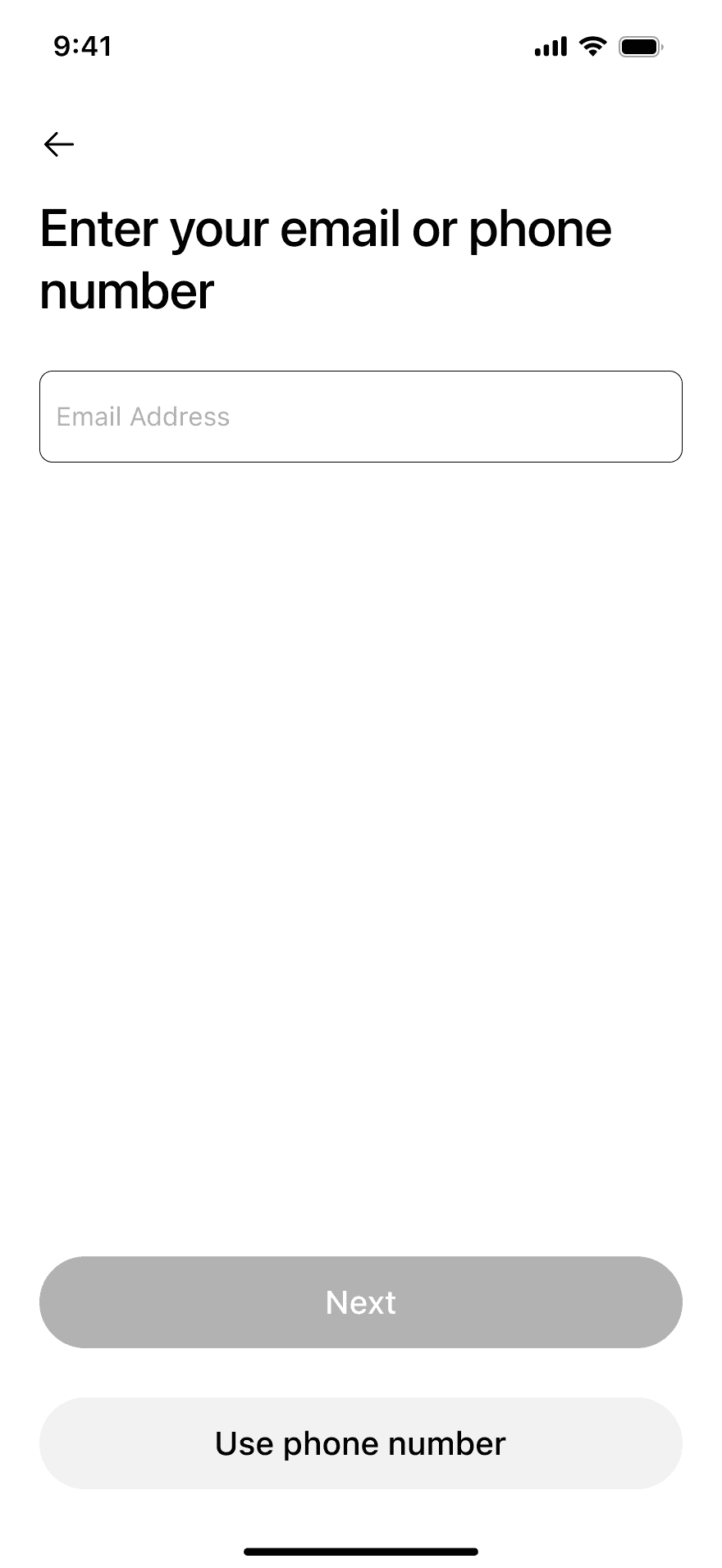

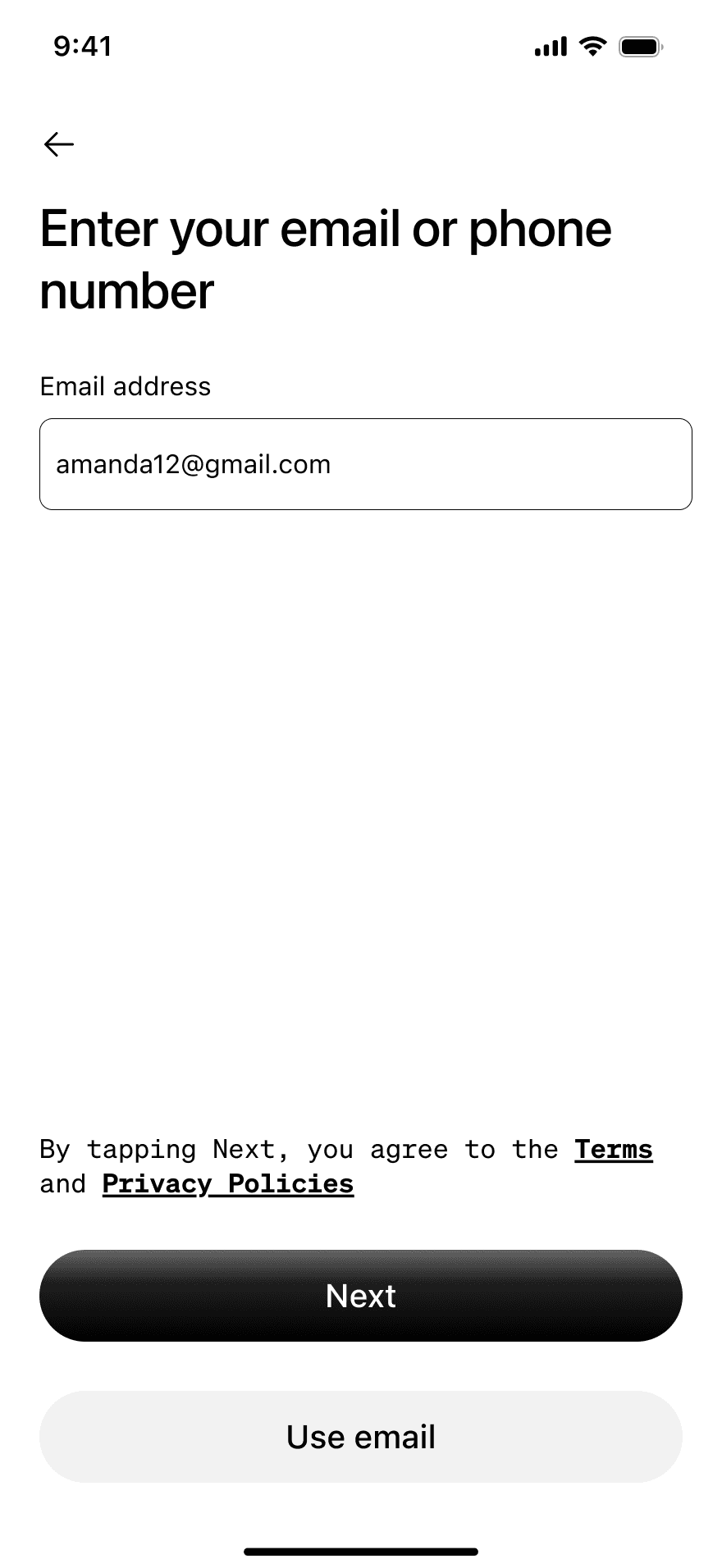

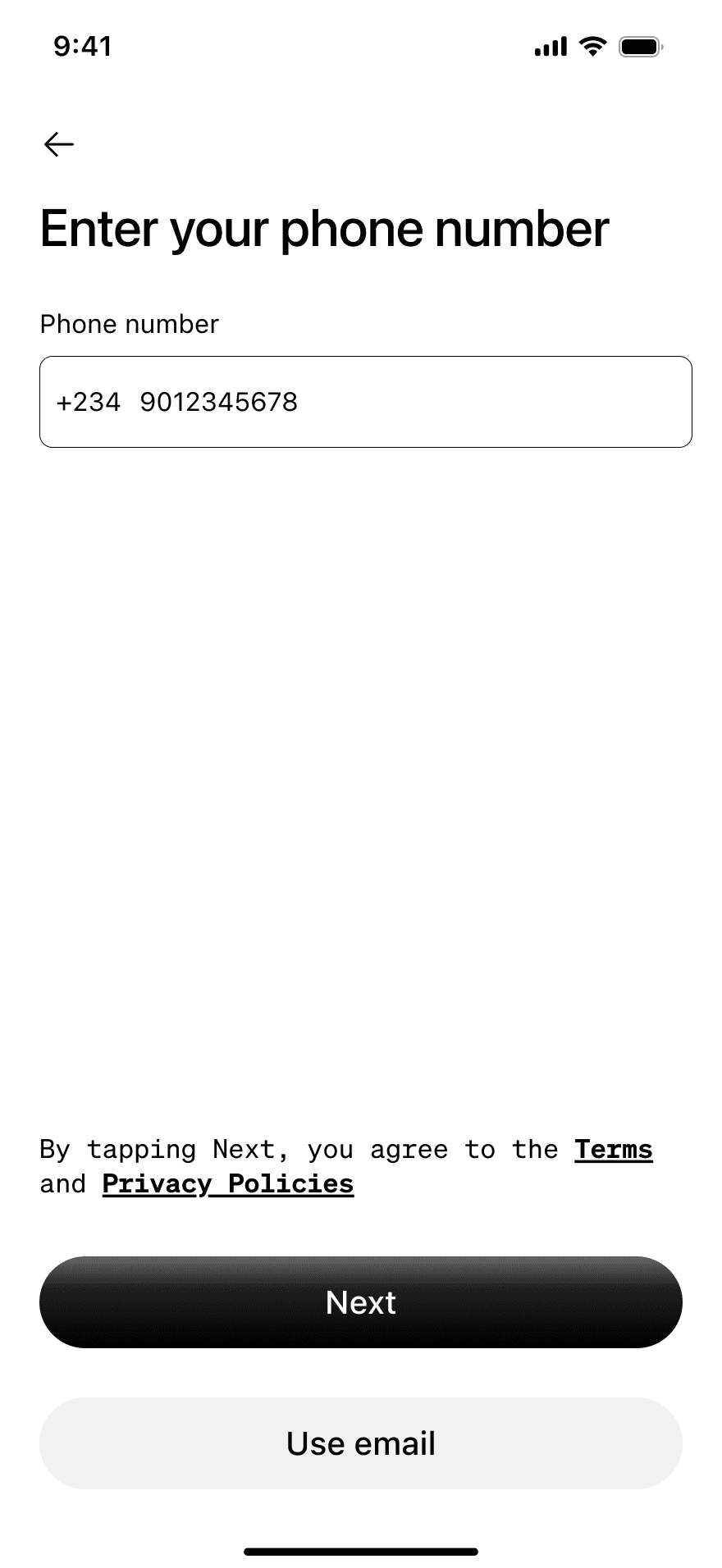

Account Creation, Entry Without Resistance

The first form field must feel reversible, not binding.

Friction is minimised

Privacy reassurance reduces subconscious form anxiety

The user still feels in control

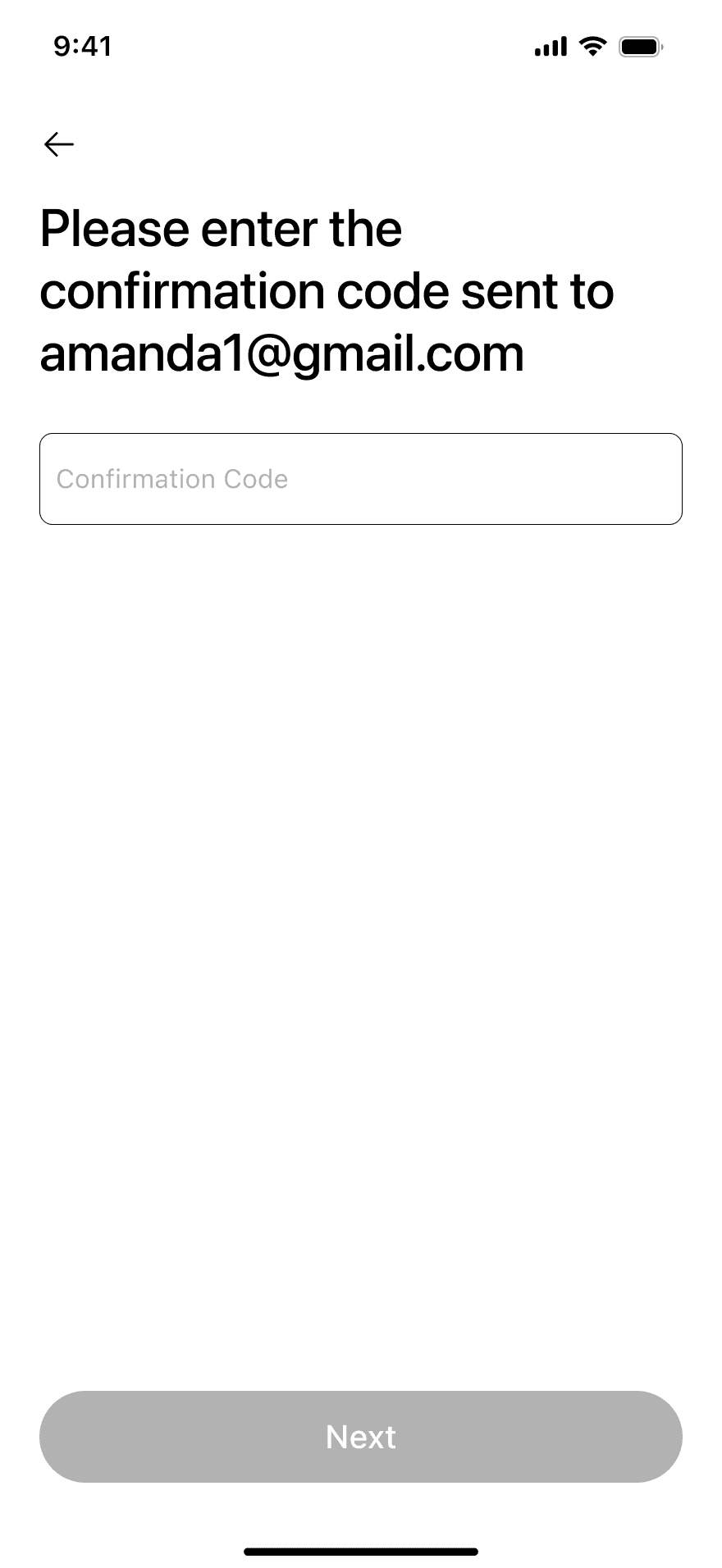

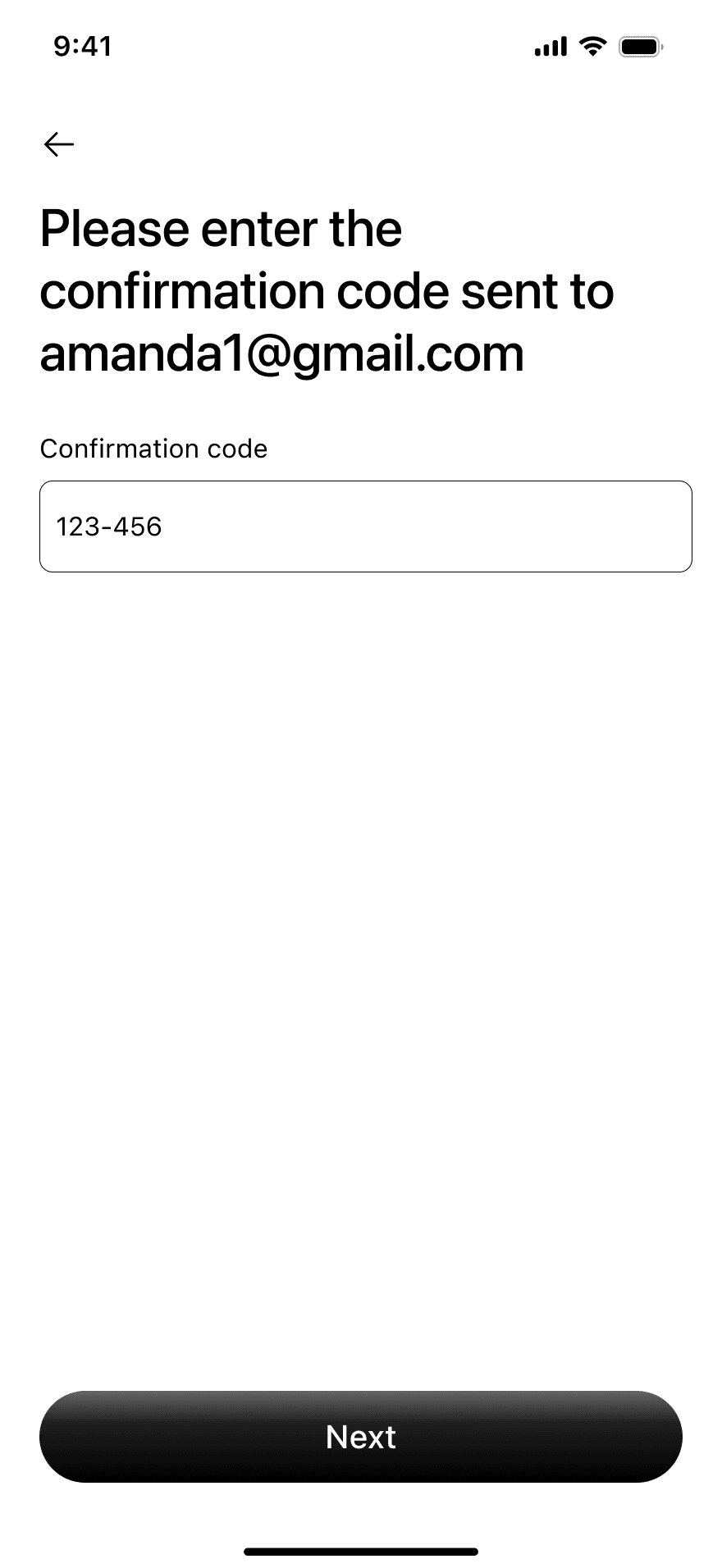

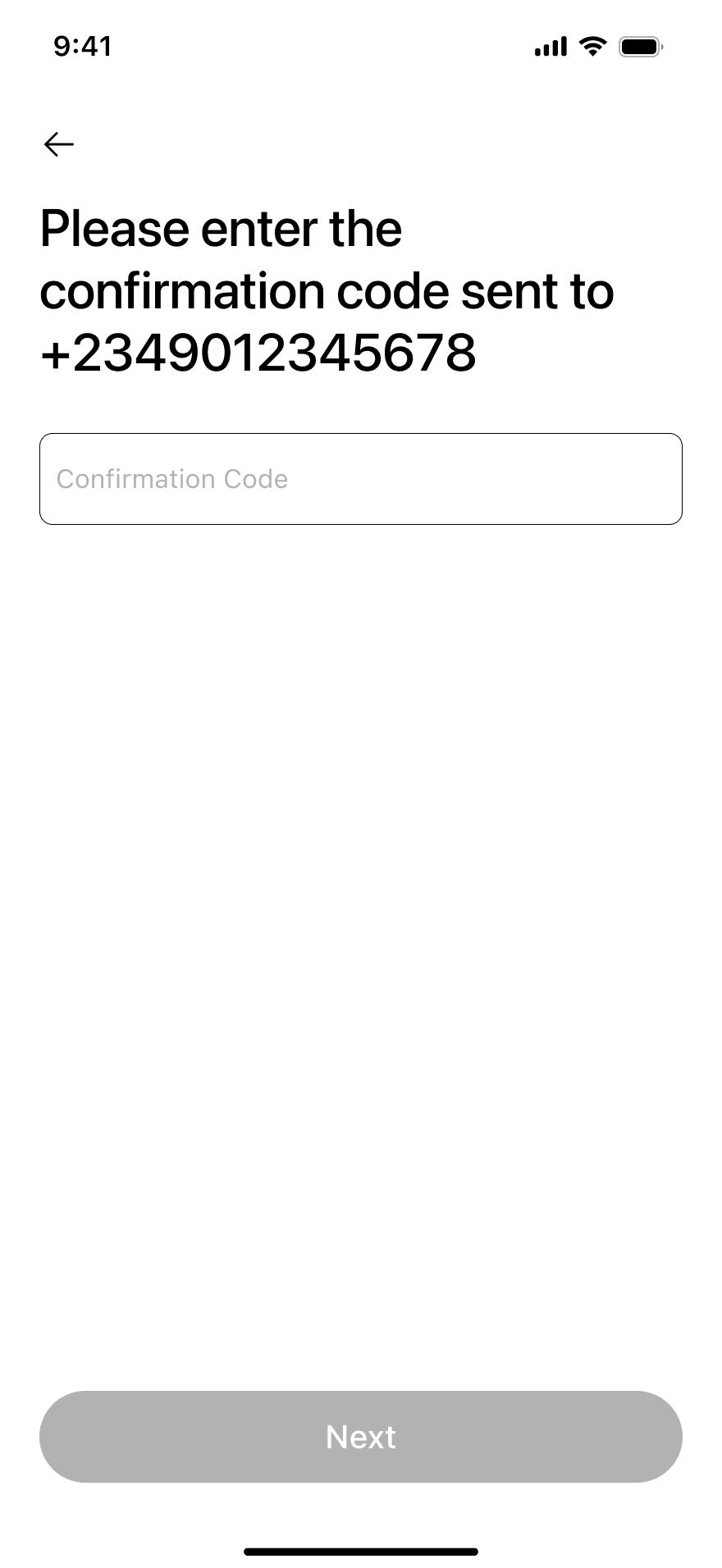

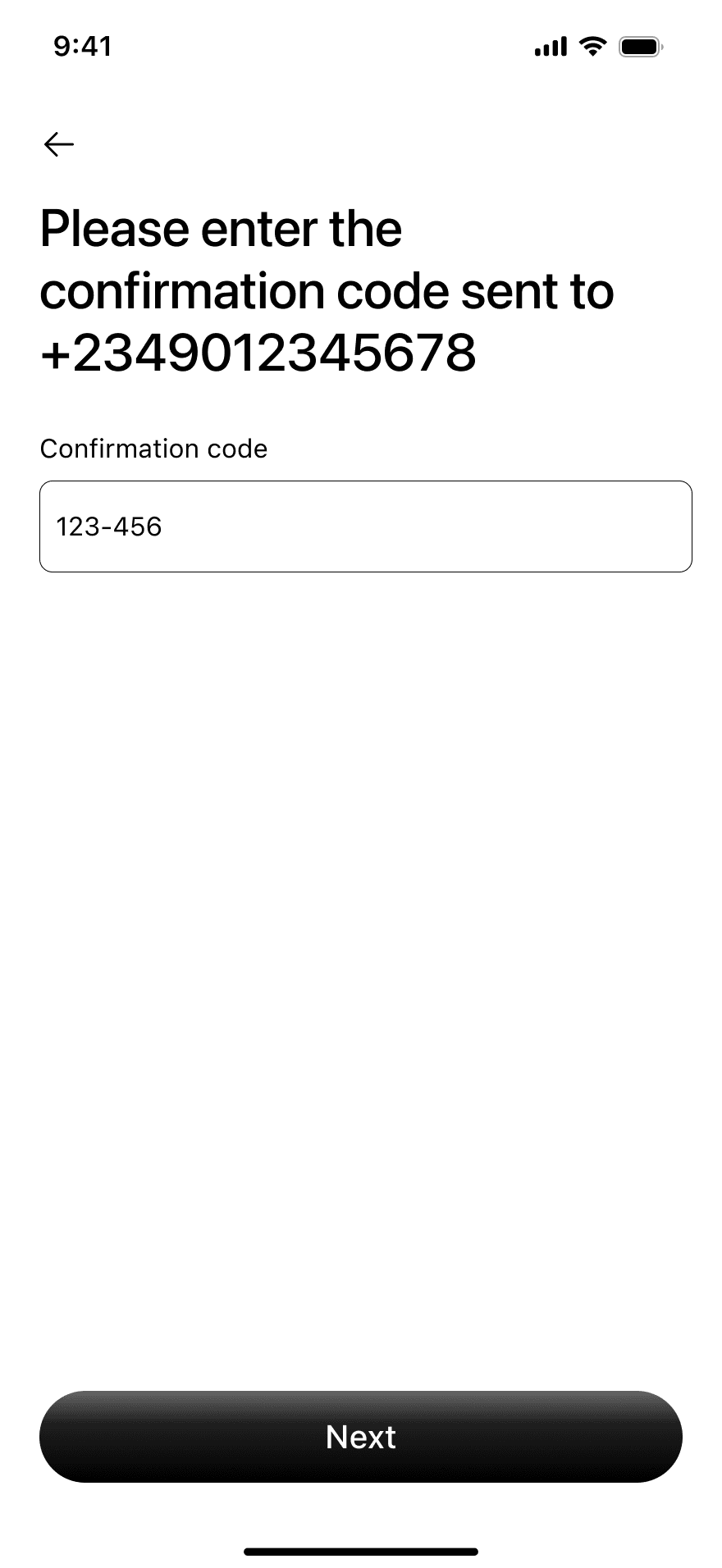

OTP Verification, Protection, Not Punishment

This is a psychological checkpoint.

Instead of feeling like a barrier, it is framed as a protective action, a small step that proves the product is watching over the user.

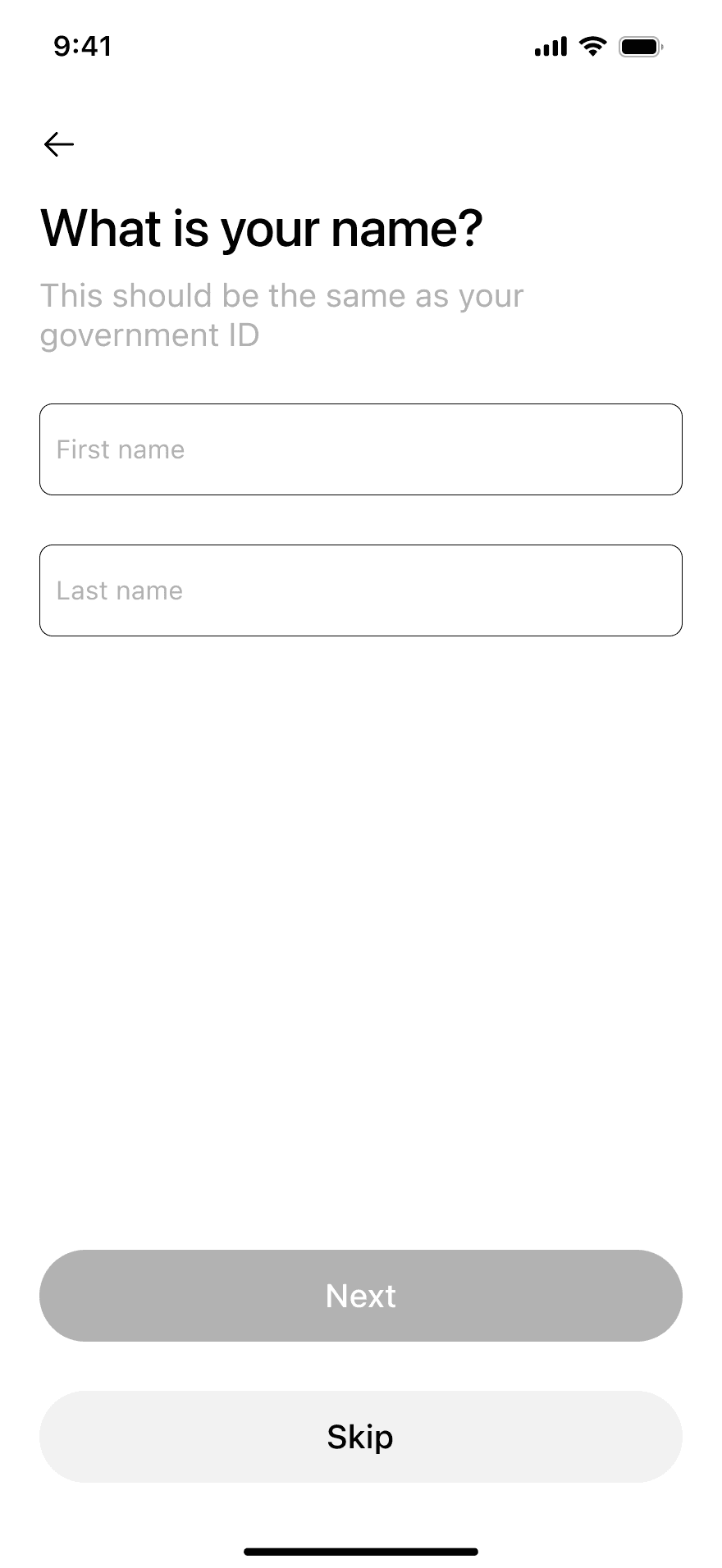

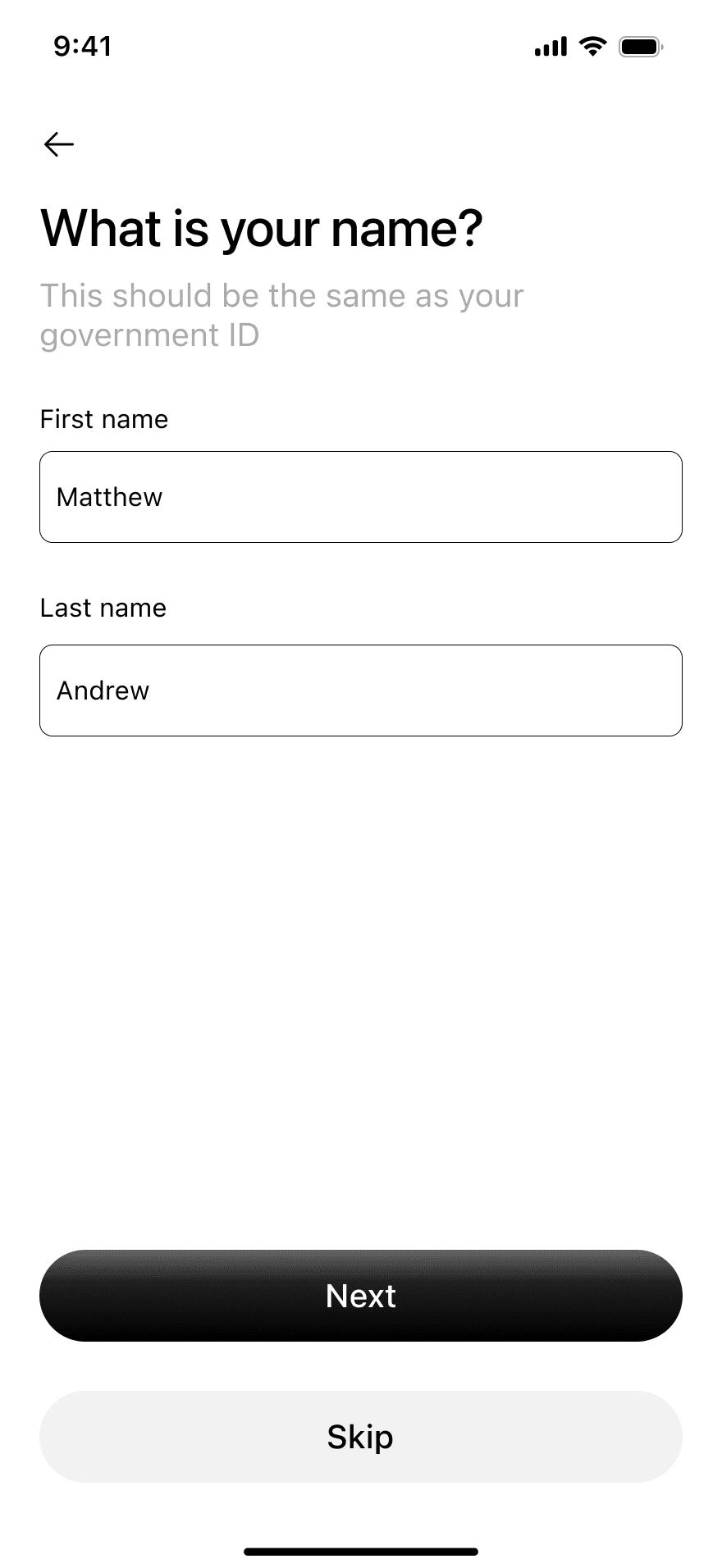

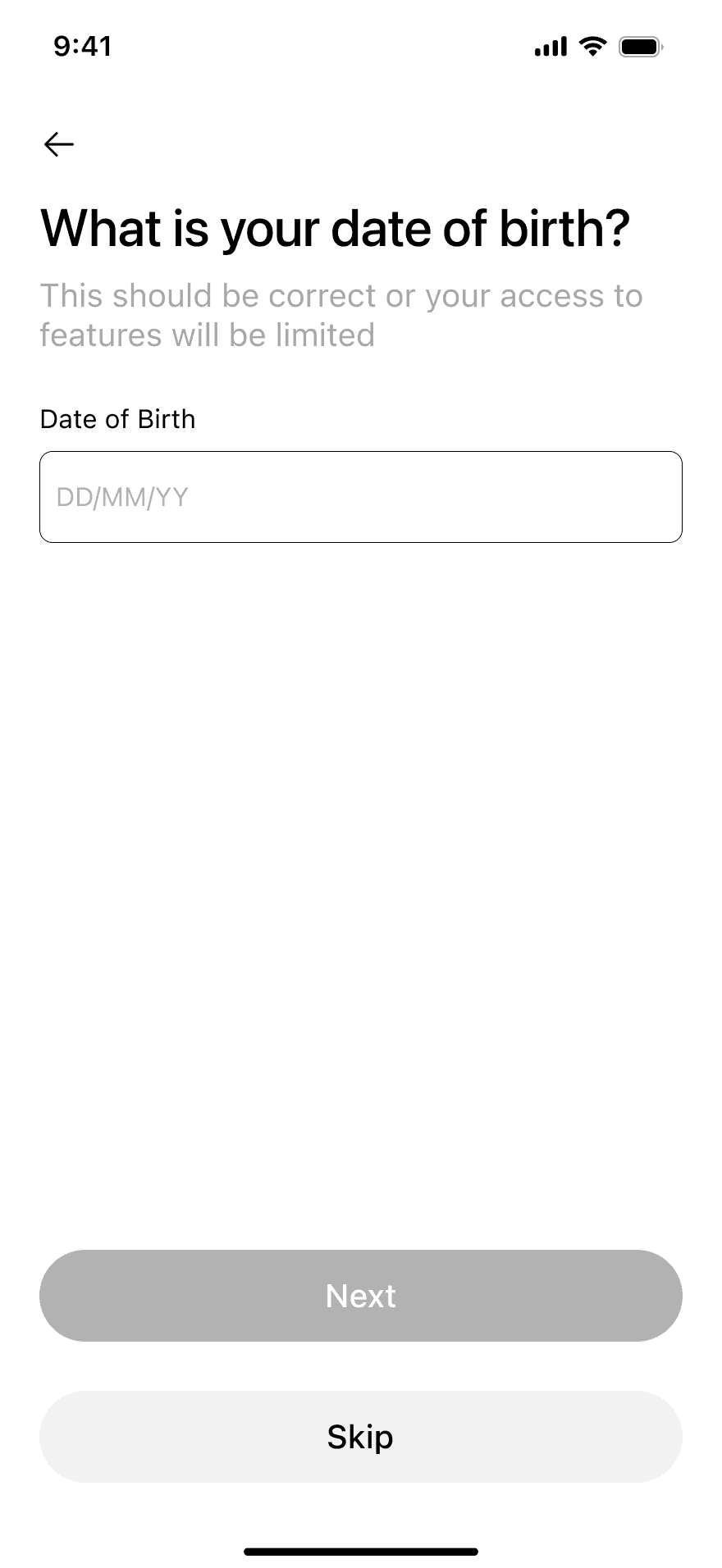

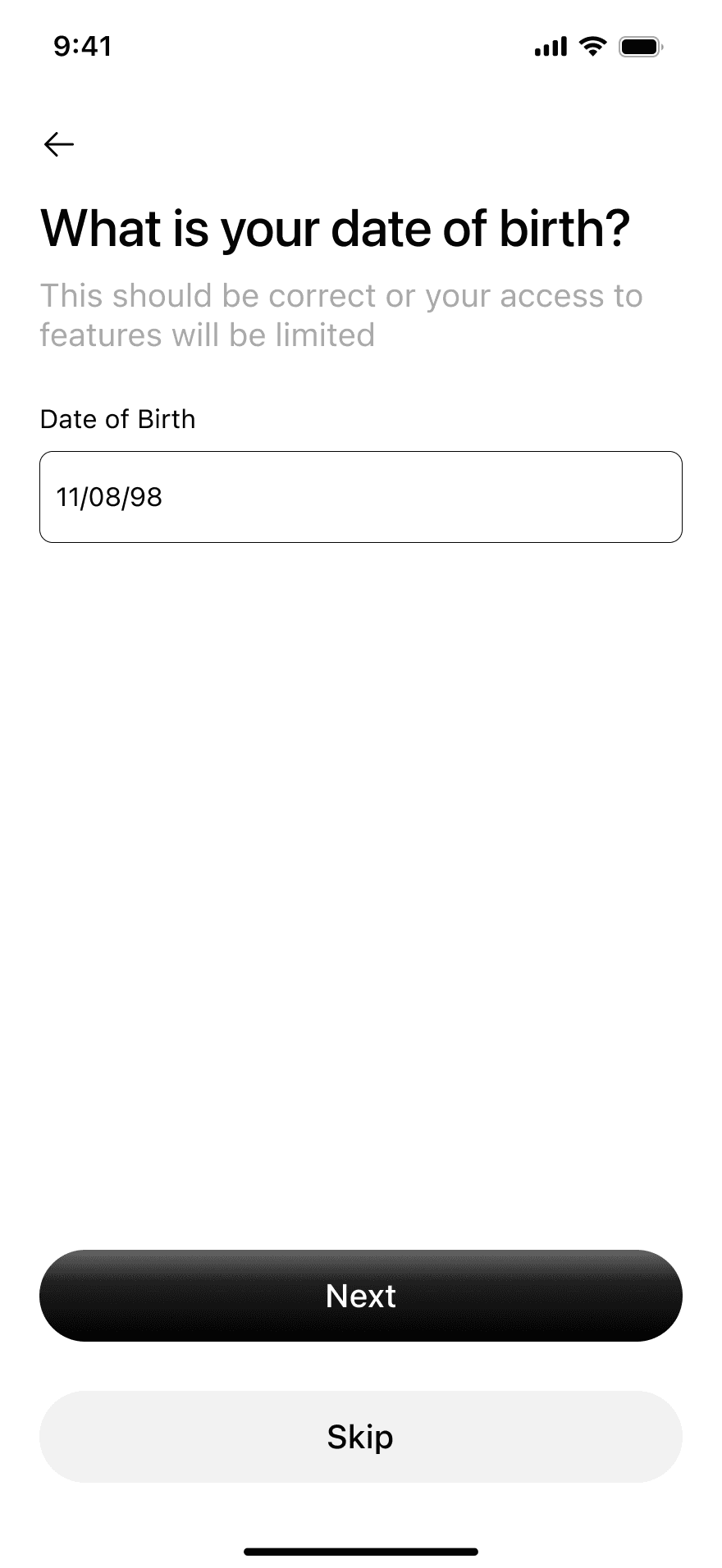

Identity Basics, Compliance Without Fear

This is where most fintechs lose people.

Here, the language shifts from regulation to personal safety, making verification feel like a shield rather than surveillance.

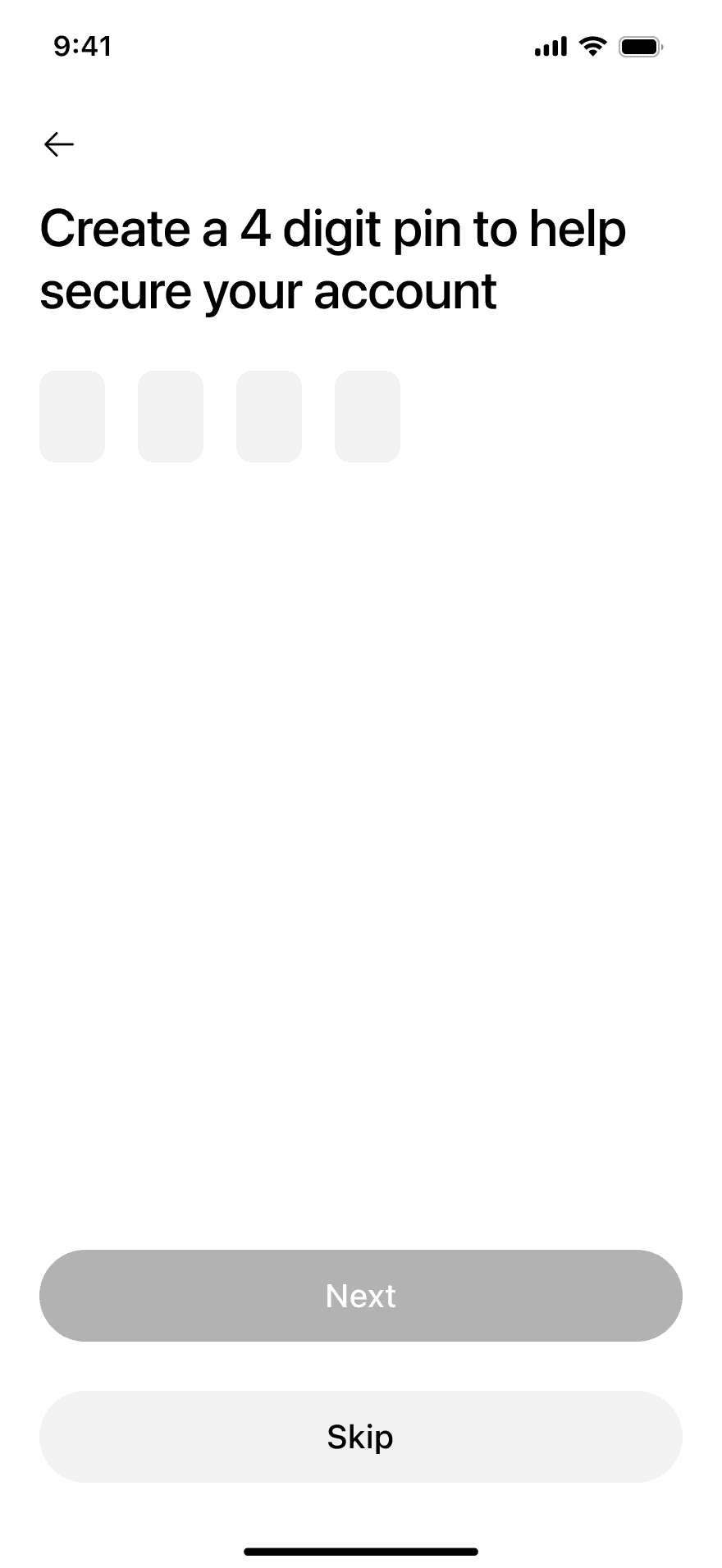

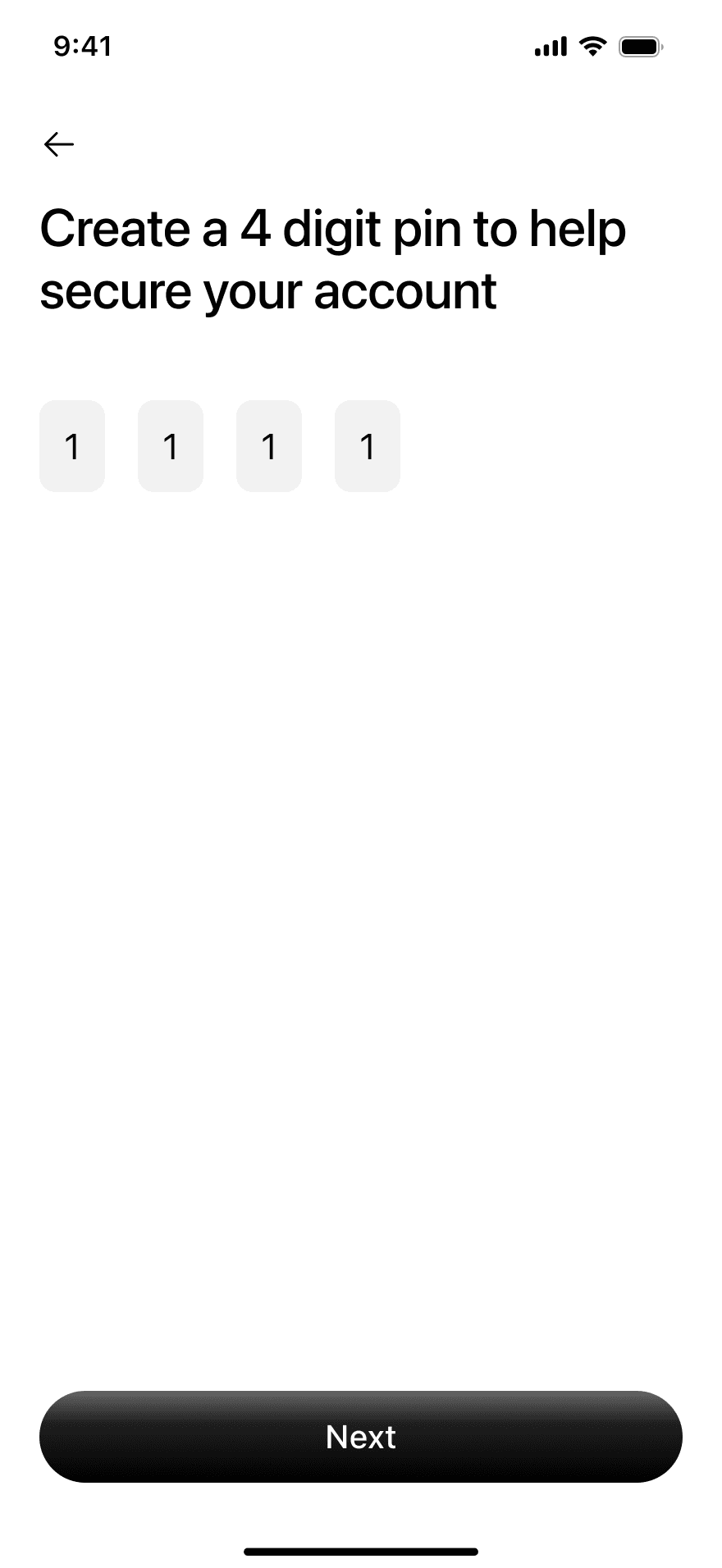

Security Setup, Ownership Transfer

This is the moment the product becomes theirs.

Explaining what the PIN protects transforms a task into a boundary of trust.

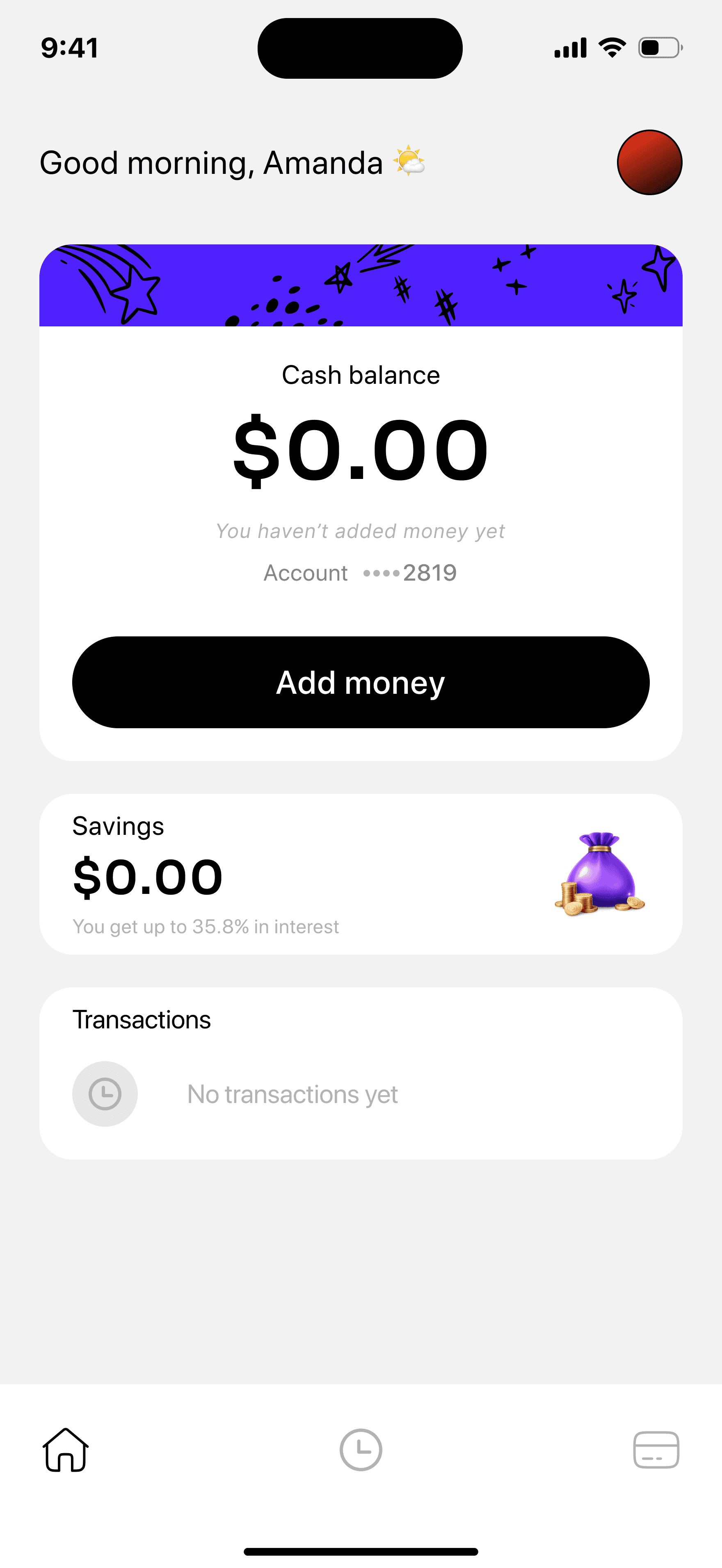

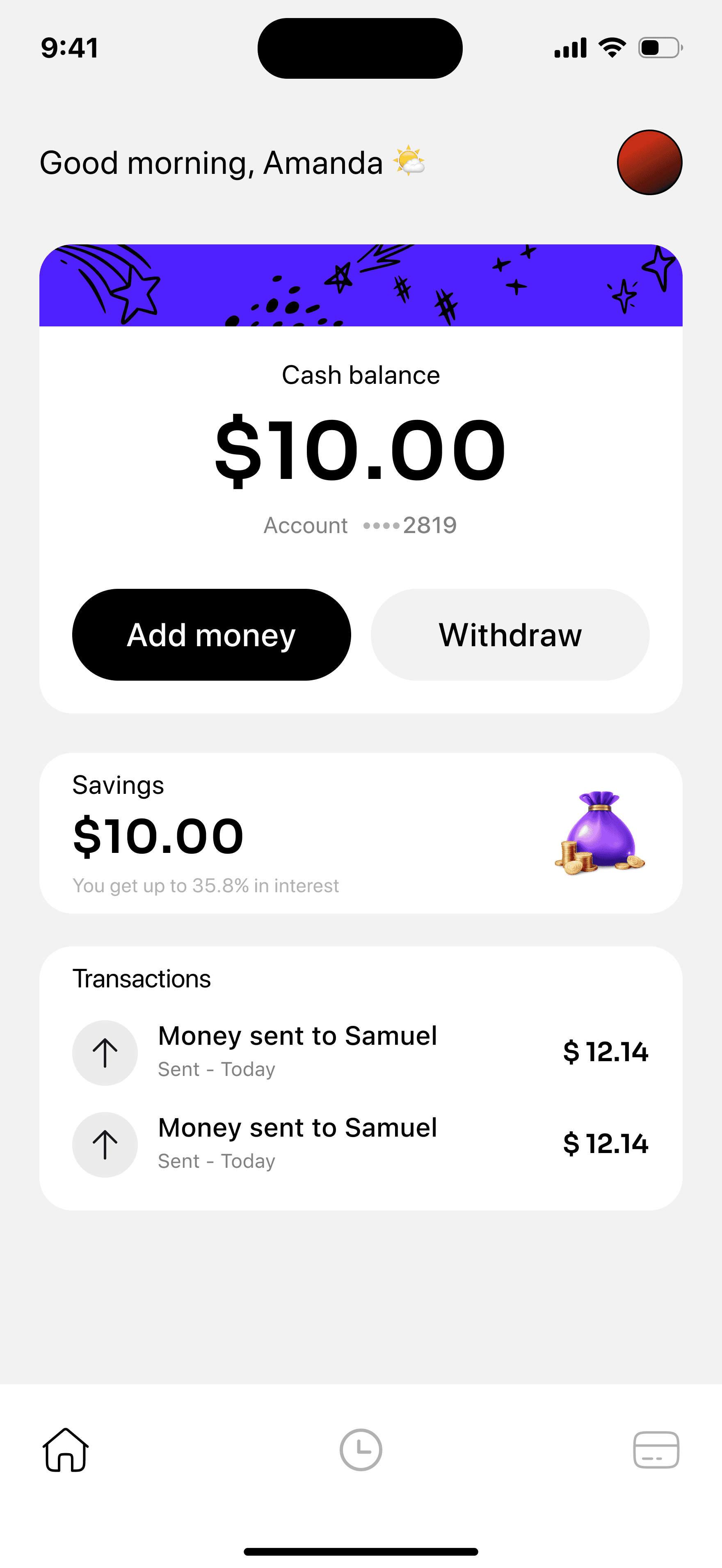

Post-Onboarding Activation Screen

This is not a dashboard.

This is a conversion engine.

Design Decisions:

Balance starts at $0.00 to avoid false trust

Only one primary action above the fold: Add Money

Withdraw hidden until account funded

Metrics This Flow Is Designed To Improve:

Key Insight

The main thing about fintech onboarding is that; is not about showing features.

It is about earning permission.

Users don’t abandon because your UI is bad, they abandon because you ask for trust before you deserve it.

Outcome

This flow reframes onboarding as a psychological journey, not a checklist.

By sequencing trust before friction, it turns sign-ups into activated users.